Seniors Learn How to Budget Their Money at JA Finance Park

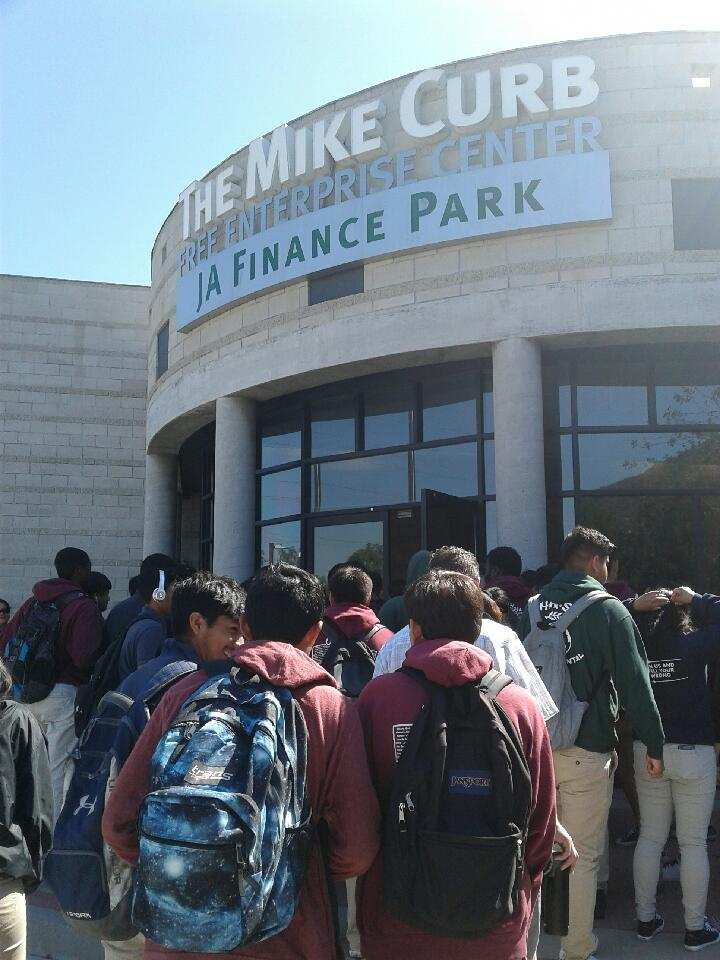

On Monday, May 22, you may have noticed that all the Seniors suddenly went missing. The truth is, all Seniors went on a very educational and valuable field trip to JA Finance Park in Los Angeles, CA. Both Mr. Dura and Mr. Launius took their economics classes on the trip, organized by Mr. Dura for the third time. The field trip consisted of a “hands-on budgeting simulation.”

Before the trip, students began doing assignments from a specific workbook created by the organization, Junior Achievement Finance Park. In the workbook, students recorded their job interests and strengths/skills. In addition to the workbook, students also took part in an online course named EverFi. The website has different modules ranging from many different topics regarding finances. Students learned about loans, savings, bank systems, and overall how to be smart when handling money. These resources were very useful, since many Seniors are going to be living on their own in college.

The trip itself lasted all day, from nearly 8:30 to 2:45 p.m. On the morning of, Seniors gathered in the cafeteria and then dispersed into one of the three buses, each fitting 40 students. Each bus was monitored by a teacher, either Mr. Dura, Mr. Launius, or Mr. Jahnke, and several parent volunteers.

Once the students arrived at the JA Finance center, they were led into a big room filled with dozens of chairs in the center of the room. The room was surrounded by small store fronts, making the entire place feel like a small community. Students sat down and the coordinator/leader of the event, Hasani Johnson, began to speak to the students and faculty. He explained that the goal of the organization was to “provide [students] with a simulation of real life that encourages [students] to take control of [their] own financial future.” Then, he explained the rules: we were to leave all belongings on the floor under the chair and ask for permission to go anywhere else. Students were then given a card with the name of one storefront. Students were instructed to report to that store front for the rest of the day.

There were more than ten storefronts, including NBC Universal, Toyota, Aaron’s, State Farm, Sports Chalet, Citibank, Capital One, Delta Airlines, and Bank of America. Once the students went to their designated store, they were introduced to their volunteer for the day. There was one volunteer for each of the stores, all with different professions. The students in each room, respectively, asked their volunteer questions about his or her career while filling out a worksheet. Then, the volunteers passed iPads around to each student. The iPad a student received determined what would be that student’s simulated life.

After a quick questionnaire on the iPad, students were randomly assigned a career, salary, family size, education, and age. Salaries ranged from 20,000 to 160,000 and students had to work with the amount they were given. Next, students were given a list of all their expenses and had to create a budget. Some of the expenses accounted for were clothing, transportation, electricity, insurance, charities, savings, groceries, childcare, and entertainment, just to name a few (there were 23 in total). Students had to try and make a budget without going over the monthly household income. This was a very difficult challenge for some students because they did not make enough money to pay for even basic necessities.

The next part was the most fun: the students had to pay their taxes! Usually, students would have to go from storefront to storefront to pay their taxes, but it could not be done because there were so many students participating. Instead, students clicked to pay for all their expenses on the iPads. Once they were done paying for their bills, students got a final review which said how much they saved and how well they were able to stick to the budget. Some students were able to save more than a thousand dollars, while others were only able to save ten dollars. Every scenario was different, and every result was different.

HMSA students really enjoyed the trip because it was both “valuable and enjoyable.” Mr. Launius agrees that students “ learned a lot about finances and how budgeting and spending works in the real world” in a short amount of time.

Future Seniors should be excited to participate in years to come because it is absolutely necessary for young adults to learn about these topics. For the Seniors, they will need to know it much sooner than they realize.